Beyond the 401(k): Employee Benefit Trends New Hires Will Come to Expect

authors are vetted experts in their fields and write on topics in which they are extremely knowledgeable. All of our content is peer reviewed and validated by world-class professionals.

It’s no secret that the Great Resignation has ignited a war between companies desperate to fill a plethora of positions. Not only are the nation’s leading employers battling for an advantage with bonuses and raises, they’re also offering plum benefits designed to entice pandemic-weary workers back into the labor force.

Take, for example, Target and Amazon, which are now covering 100% of college costs for US employees. While many large companies have offered partial tuition reimbursement to salaried employees for years, businesses are now taking these programs a step further—by extending the benefit to hourly employees and picking up the entire tab—to attract and retain talent.

“It’s a move that firmly establishes a new era for employee benefits and further proves that benefits have become the go-to market strategy for employers willing to fight for and retain top talent,” Jeff Oldham, co-founder at Informed Consulting, a benefits consulting firm for early- and mid-stage digital health companies, tells Staffing.com.

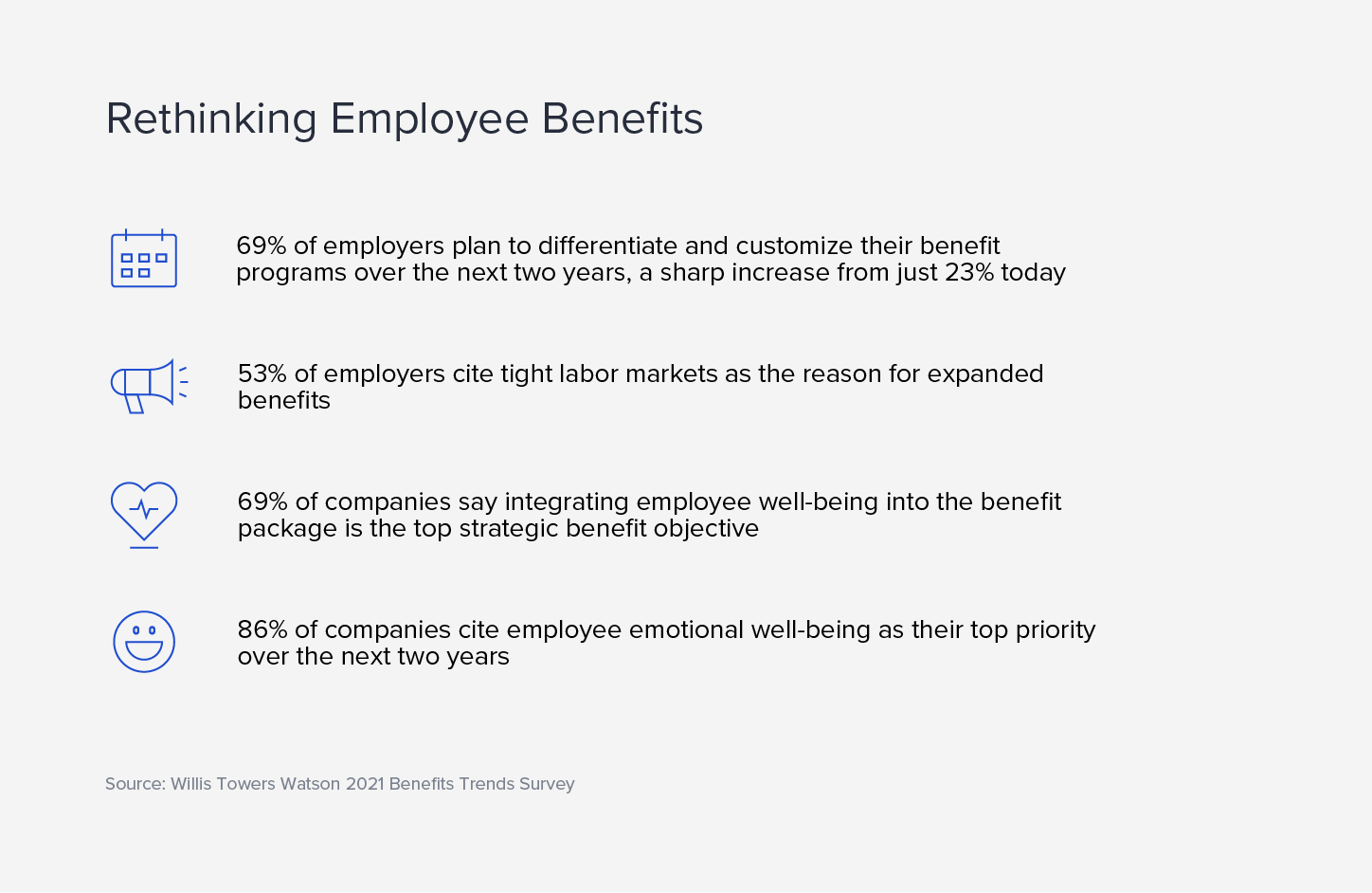

Not every company can offer free education, but savvy corporate leaders take note: It will take more than basic health insurance and a 401(k) match to persuade today’s workers. Increasingly, corporate leaders are rethinking the traditional one-size-fits-all approach to benefits. A 2021 Benefits Trends Survey by Willis Towers Watson found that more than two-thirds of employers (69%) plan to differentiate and customize their benefit programs over the next two years to address the individual needs of their workforce and offer significant flexibility and choice in benefits.

While the explosive growth in personalized perks—including caregiving support and mental health services—has certainly been intensified by pandemic-induced labor shortages, it’s not the only reason employers are giving their workers access to a growing suite of services. “There are two macro trends driving the evolution of benefits,” Oldham says. “For the first time in American history, there are five generations in the workforce. You can’t copy and paste healthcare, dental, life, and disability insurance and think it’s going to satisfy your entire workforce.” Oldham, whose clients have sold their services to major enterprises, including Blue Cross Blue Shield, Aflac, and Allstate, says an elongated period of relatively flat wages is also driving the expansion of benefits. “The majority of industries in the country have to use benefits as a mechanism to recruit and retain employees, as opposed to significant increases in salaries. It’s vital now to offer a diverse array of benefits to both align with the workforce and fight in the war for talent.”

Here are the prime perks that will set forward-thinking employers apart in the coming years:

Tuition and Student Debt Assistance

US student loan debt reached an all-time high of $1.7 trillion in the second quarter of 2021, so it’s not surprising that companies are competing for workers by making college more affordable (or even free). This year, the country’s top retail behemoths rolled out new or expanded plans to cover college costs. At Kroger, workers who have been with the company at least six months can receive up to $3,500 a year for tuition—up to $21,000 over the course of employment. Target now covers the cost of associate and undergraduate degrees for its more than 340,000 employees at more than 40 schools, colleges, and universities. Beginning in January 2022, Amazon will fully fund college tuition, as well as high school diplomas, GEDs, and English as a Second Language (ESL) proficiency certifications for 750,000 operations employees.

Walmart covers most costs associated with college tuition and books for its 1.4 million employees when they attend one of its select academic partners. “We look for associates that might be interested in finishing their high school education or getting a degree,” Donna Morris, Executive Vice President and Chief People Officer for Walmart, tells Staffing.com. Then, employees can participate in “a program which we call Live Better University. It’s in partnership with Guild, another organization that helps us negotiate different contracts with educational providers. So I can actually get my formal degree or diploma from an educational institution for as low as one dollar a day on the part of the associate, and then Walmart is paying for all of the balance of that learning.” Walmart also invests in on-the-job learning and tools through its academies. “We have more than 200 academies across the US,” says Morris. “These academies provide very targeted learning. For instance, if I want to learn to be a cake decorator or work in our auto center, or if I’m a team leader, there would be specific learning that I would participate in through our academies.” Employees have participated in more than 2 million training sessions during the past 18 months alone.

Inventive companies are also helping their workers pay down student debt, including letting employees exchange unused paid time off (PTO) for payments against their student loans. At insurance firm Unum, for example, the company’s 9,500 US employees can transfer up to 40 hours of carryover PTO into a payment against school loans. And since so many young workers delay saving for retirement while paying off their student debt, some companies (including Abbott Laboratories, Travelers, and Raytheon Technologies) have started matching their employees’ student loan repayments with contributions to their 401(k) plans.

Caregiving Support

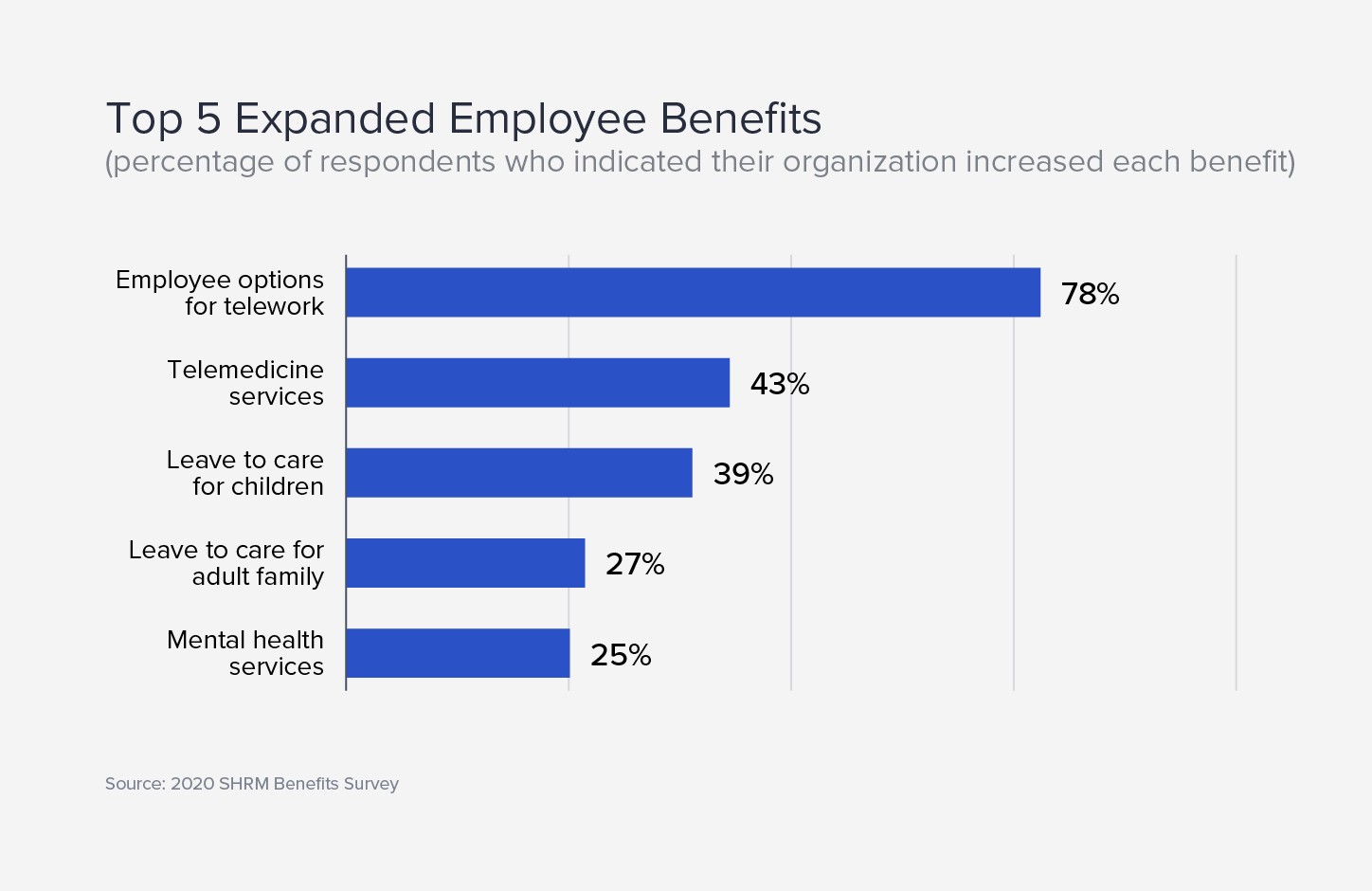

When schools and day cares shuttered during the height of the pandemic, millions of women left the workforce. The crisis emphasized just how crucial caregiving support is for working parents—and employers are taking note. More than a third (39%) of HR professionals said their companies expanded leave to include care for children in 2020, according to SHRM’s annual Benefits Survey. Many also beefed up their backup child care benefits by providing reimbursement or partnering with child care providers. Bright Horizons Family Solutions, the largest provider of employer-sponsored child care in the US, says more than 100 of its new clients added backup care benefits in 2020.

Employees also need support caring for their aging parents. An estimated 34.2 million US adults look after someone over the age of 50. To ease the load for workers who might be tending to an ill or aging relative (or those in the “sandwich generation” who are responsible for both kids and adults), some companies are broadening their paid leave policies to include care for parents, spouses, and other family members. Companies are also providing legal resources to help with contracts or caregiving-assistance services that help locate the appropriate long-term facilities.

Mental Health and Wellness Support

Burnout, depression, anxiety, and substance abuse are all on the rise, and wise employers are expanding their mental health and wellness benefits to help workers find the help they need. In the Willis Tower Watson survey, 86% of employers cited employee emotional well-being as their top priority over the next two years, and 73% said they plan to boost their support for mental health (defined as stress, burnout, and depression).

That includes adding or expanding employee assistance programs (EAPs), expanding health coverage for in-person behavioral services, providing discounts or free access to mental health apps, and adding more virtual services, from therapy to yoga classes.

Zoetis, a Fortune 500 global animal health company, has always offered an EAP, but last year, the company invested more in the program. Improvements included offering a higher quality provider network, improved technology to obtain mental health benefits, and more visits at no cost, Tammy Bakos, VP of Total Rewards at Zoetis, tells Staffing.com.

“The ‘old’ way to access mental healthcare was to call the EAP, and they would put you in touch with a provider. You really didn’t know anything about the provider except that they were available to see you. Often it seemed like something only for people in crisis rather than a preventive approach to mental healthcare,” says Bakos. “This new approach uses technology to remove the barriers to accessing the right care from the right provider at the right time. It gives the patient a chance to shop for a provider and book appointments directly online. Visits are in person or via video, making it more convenient than ever to get the needed care.”

More Affordable and Convenient Healthcare

Since 2009, average family healthcare premiums have increased 54% and workers’ contributions have increased 71%, according to the Kaiser Family Foundation. Jeff Faber, Chief Strategy Officer for global insurance brokerage HUB International’s Employee Benefits practice, tells Staffing.com that he predicts employers will shoulder the lion’s share of premium increases in the coming years.

That’s not the only way companies are cutting down on healthcare costs for employees. Fewer employers are offering only a high-deductible health plan, and more are using methods such as reference-based pricing and bundled payments that allow them to cut down on employees’ costs by essentially setting their own prices for services like surgeries, he says.

Not all companies can control healthcare costs so easily, but many are providing a big assist to employees by making access to care more convenient. The rapid expansion of telemedicine services (also fueled by the pandemic) is a prime example. Nearly half (43%) of HR professionals said their companies expanded the benefit in 2020, according to the SHRM survey. Oldham expects employers to continue to expand their digital health offerings, particularly in the areas of women’s benefits (with services such as Maven, Natalist, and Progyny), behavioral health (e.g., Headspace, Lyra Health, and Spring Health), and digital musculoskeletal solutions (e.g., Hinge Health, Sword Health, and Kaia Health).

White-glove Service

Not only are savvy employers expanding their range of benefits, they’re also providing access to concierge services that make it easier for their employees to manage life outside of the office. For younger workers, Faber says, that means access to services that help them navigate home buying, car buying, moving, and more. For employees with children or aging parents, companies like Best Buy are offering access to Wellthy, a personalized caregiving support platform that helps employees tackle the logistical and administrative tasks of caring for loved ones. To help workers navigate complex healthcare decisions, companies are offering access to digital healthcare concierges, such as Rightway, Accolade, and Quantum Health.

That emphasis on providing a personal touch will be crucial for companies that want to win the war for talent. A new study by the ADP Research Institute found that employees are twice as likely to see HR as valuable when they have just a single point of contact—and they’re more likely to recommend their company to a family member or friend as a place to work. After all, a wide array of perks isn’t a plus if employees can’t understand or access the offerings. “Navigating the world of HR as an employee is difficult, and knowing who to call for anything is difficult,” Marcus Buckingham, co-head of the ADP Research Institute, tells Staffing.com. “A single point of contact can help to navigate the HR systems and processes.”

As workplaces and workforces continue to evolve, companies that continuously look for ways to support their employees will gain an advantage in hiring and retaining top talent.